Introduction to "The Big Short""The Big Short" is a 2015 biographical comedy-drama film directed by Adam McKay, which is based upon the 2010 book "The Big Short: Inside the End ofthe world Maker" by Michael Lewis. The movie stars an ensemble cast including Christian Bale, Steve Carell, Ryan Gosling, and Brad Pitt, and it tracks the accumulation of the housing and credit bubble throughout the 2000s that led to the monetary crisis of 2007-2008.

The Premise of The Financial MeltdownAcclaimed for its sharp and negative take on among the darkest periods in monetary history, the film concentrates on the stories of a number of monetary experts who foresaw the collapse of the housing market and devised a way to benefit from it. It dives deeply into the complex monetary instruments and the widespread corruption in the financial sector that precipitated the crisis.

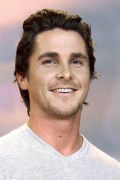

Key Characters and Their StoriesChristian Bale represents Dr. Michael Burry, a hedge fund supervisor with an eccentric character and a penchant for heavy metal music, who recognizes that the U.S. real estate market is very unsteady, constructed on high-risk subprime loans that are most likely to stop working. Burry creates a strategy to "short" the real estate market by buying credit default swaps, essentially betting against mortgage-backed securities.

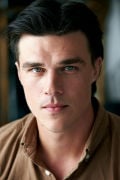

Ryan Gosling plays Jared Vennett (based upon Greg Lippmann), a Deutsche Bank salesperson who stumbles upon Burry's analysis and decides to sell the idea of shorting the real estate market to others. Steve Carell depicts Mark Baum (based upon Steve Eisman), a principled hedge fund manager who, after hearing Vennett's pitch, investigates and ends up being convinced that the market is on the verge of collapse.

Brad Pitt portrays Ben Rickert (based upon Ben Hockett), a retired banker and coach to 2 young investors, Charlie Geller and Jamie Shipley, who unintentionally find the approaching crisis and, with Rickert's assistance, purchase credit default swaps.

Exposing the Flaws in the System"The Big Short" is ingenious in its approach to describing complex monetary jargon and concepts. It uses direct-to-camera monologues and cameos from celebrities like Margot Robbie and Anthony Bourdain to break the fourth wall and clarify these concepts for the audience in a digestible manner.

The characters become significantly appalled by the carelessness and deceitful behavior they discover-- home mortgage lenders distributing loans to unqualified debtors, score firms offering undeserving AAA rankings, and financial investment banks looking the other way as long as profits keep rolling in. This cocktail of greed and incompetence is illustrated as the driving force behind the bubble that ultimately bursts.

The Fallout and ConclusionAs the inevitable crash begins, the investors come to grips with the ethical implications of benefiting from the monetary disaster that caused regular people to lose their homes and jobs. Despite their individual triumphes from a monetary perspective, the tone is bittersweet, with a heavy critique of the actions (and inactions) that caused widespread economic damage.

The film nearby depicting the after-effects of the crisis: little reform in the monetary industry, the payment of large bonuses to executives who added to the collapse, and the suffering of regular people bearing the impact of the recession. "The Big Short" ends by explaining that comparable financial products are back on the marketplace under different names, recommending a cycle that may duplicate itself.

In Summation"The Big Short" artfully integrates education and home entertainment, giving audiences a grasp of the complicated aspects that resulted in the monetary crisis. With its mix of humor, outrage, and stark storytelling, it paints a vibrant photo of among the most considerable financial slumps in modern history, acting as both a cautionary tale and a scathing indictment of the monetary market.

Top Cast